Best Cryptocurrency to Invest In

Since Bitcoin showed up on the scene in 2009, digital currencies have been acquiring in ubiquity. While previously considered as an elective method for trade — without the requirement for government-upheld (or “fiat”) cash — today crypto is additionally viewed as something you can put resources into.

There are over 6,800 different types of cryptocurrencies on the market today.1 However, the best ones for investing are those with a significant market capitalization. You can take into account the total value of an issued crypto coin using market capacity, also known as “market cap,” just as you would with stocks.

The bigger the market cap, the almost certain it is to be fluid. There’s likewise a superior potential for success it will have everyday hardship. Be that as it may, dissimilar to stocks, digital currency guarantors don’t distribute budget summaries. As a result, it’s critical to make use of the few metrics that are available.

There’s no assurance that any digital money will not vanish, regardless of how enormous or famous it is. These resources have no managed monetary or legislative go-between. While you’re attempting to sort out the best digital currency for you to put resources into, you ought to verify whether it’s accessible on a trade.

Tip

Assuming you’re new to crypto, it’s a good idea to put resources into one that you comprehend. Contemplate utilizes past whether a vehicle of trade more individuals are probably going to embrace.

Actually 2021, the top digital forms of money by market cap are Bitcoin and Ethereum, trailed by Binance Coin, Tie, and Cardano.1

Bitcoin

Bitcoin (BTC) started off the crypto upheaval when it was made in 2009. The first maker remains generally a secret, however it’s guaranteed that the pioneer’s name is Satoshi Nakamoto. As of October 27, 2021, Bitcoin’s market cap was 44% of the market, around $1.1 trillion.2

Note

Bitcoin utilizes blockchain innovation, which takes into consideration distributed exchanges utilizing a digitized and decentralized record. That implies there is no requirement for an outsider to check data or to go about as a clearinghouse.

Bitcoin made it workable for individuals all over the planet to send cash to one another quickly. There’s compelling reason need to stress over trade rates or bank wire move expenses.

Bitcoin is tracking down standard acknowledgment as a strategy for installment. As a venture, however, its cost has seen wild vacillations. In mid 2017, its cost crossed $1,000 interestingly, soaring to more than $19,000 around the year’s end; it then, at that point, collided with around $3,000 a year after the fact.

By April 2021, Bitcoin had picked up speed once more, crossing $64,000 prior to seeing some cost adjustment. One more cost bounce occurred in October 2021, when the first bitcoin-based trade exchanged store entered the market.23

Ethereum

While Ethereum (ETH) sent off in 2015, it was first conceptualized in 2013 by Vitalik Buterin.4 Ethereum utilizes blockchain innovation, yet at the same it’s programmable. Ethereum is intended to be open access and give various applications.

The manner in which Ethereum works makes it conceivable to accomplish more than handle cash. It’s one of the drivers behind “shrewd agreement” innovation, and that implies that different arrangements can be safely executed straightforwardly between parties. For example, you could finish a land buy by involving Ethereum without the requirement for an escrow account.

For individuals who put stock in blockchain innovation for more than monetary exchanges, Ethereum might be a decent long haul venture. That likewise could be valid for the people who need to purchase more than a money,

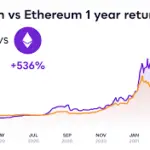

As of October 2021, Ethereum exchanged at more than $4,000 and directed more than a $460 billion market cap.5

Binance Coin

Binance Coin exchanges with the image BNB. It was sent off through an underlying coin presenting in 2017 by the group that only 11 days after the fact sent off the Binance crypto trade. BNB was first sent off on the Ethereum organization yet moved to its own Binance Chain in April 2019.

One of the large advantages of BNB is a 25% rebate in the event that you utilize the digital money to pay exchanging charges on Binance.com and Binance DEX trades. In any case, the markdown diminishes over time.6 As of October 27, 2021, BNB had a market cap of more than $75 billion and exchanged for more than $450.7

Cardano

Sent off in 2017, Cardano is a public blockchain stage. The name of its cryptocurrency is ADA. Cardano uses a proof-of-stake (PoS) protocol rather than a proof-of-work protocol, which sets it apart from other cryptocurrencies. Verification of-stake conventions utilize the quantity of blockchain tokens a client needs to add the blockchain as opposed to how much work that has been finished.

As a result, Cardano and other Proof-of-Stake (PoS) protocols are referred to as “green coins” because there is less of an incentive to mine or attack the blockchain with a lot of energy. Cardano has a market cap of $64 billion as of October 27, 2021.8

Which Cryptographic money Is Ideal for You?

Generally, putting resources into crypto resembles most other resource classes, however there are higher dangers that show up with this kind of speculation.

Tip

You can put resources into crypto for as little as a dollar. You might in fact buy it utilizing a Visa.

You can begin by opening a record with a trade like Coinbase, Gemini, or Binance, among numerous others. You might in fact trade crypto from your money market fund on exchanging applications like Robinhood.

Similarly as with any speculation, the best digital forms of money to put resources into will meet your requirements and reflect your thought process is probably going to occur from here on out. Since they are new, digital forms of money are as yet unpredictable in valuing; Their viability in the future is uncertain.

Subsequently, ponder the amount of your portfolio ought to be in crypto. Be certain that distribution is in accordance with your gamble profile.

Habitually Clarified pressing issues (FAQs)

What are the dangers of putting resources into digital money?

Digital currencies are as yet a somewhat new type of venture, and they have developed quickly since their presentation in 2009. The immense value swings of a portion of these monetary standards ought to give any financial backer justification behind alert. Crypto isn’t also directed as different protections, and a significant part of the exchanging happens abroad, further expanding the dangers. You ought to just put resources into digital currency in the wake of finding out about the risks and guaranteeing that you have other, more secure speculations to balance the risks.9

Could you at any point get rich putting resources into digital currency?

The gamble of cryptographic money has a flip side: the potential for outsized returns. On the off chance that you had put $1,000 in Bitcoin 10 years prior, for example, you’d be a mogul many times over today. However, predicting which currencies will rise to the top and which will plummet is not always straightforward. That is the reason keeping a sober mind and utilize a decent money management strategy is significant.