Pros and Cons of Investing in Stock

When you buy stock in a company, you become a shareholder in that company. As the organization develops, you can anticipate that the stock should convey a profit from your speculation. What are the upsides and downsides of putting resources into the financial exchange?

By and large, the securities exchange has conveyed liberal re-visitations of financial backers after some time, yet it additionally goes down, giving financial backers the chance of the two benefits and misfortunes, for hazard and return.

Stock Financial planning Upsides and downsides

Professionals

Develop with economy

Remain in front of expansion

Simple to purchase

Needn’t bother with truckload of cash to begin financial planning

Pay from value appreciation and profits

Liquidity

Cons

Risk

Investors of broke organizations get compensated last

Gets some margin to investigate

Charges on beneficial stock deals

Close to home promising and less promising times

Rivaling institutional and proficient financial backers

6 Benefits of Stock Financial planning

Corporate share offers a lot of advantages:

Exploits a developing economy: As the economy develops, so do corporate profit. That is on the grounds that monetary development makes occupations, which makes pay, which makes deals. The fatter the check, the more prominent the lift to purchaser interest, which drives more incomes into organizations’ sales registers. It assists with understanding the periods of the business cycle — extension, pinnacle, constriction, and box.

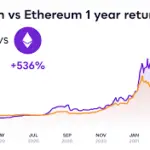

Most ideal way to remain in front of expansion: By and large, over the drawn out stocks have yielded a liberal annualized return. For instance, the S&P 500’s 10-year annualized return was 10.92 percent on August 30, 2024.1 This is higher than the typical annualized rate of inflation. It implies you should make some more extended memories skyline, be that as it may. Like that, you can purchase and hold regardless of whether the worth briefly drops.

Simple to buy: The securities exchange makes it simple to purchase portions of organizations. They can be purchased online or through a broker or financial planner. Whenever you’ve set up a record, you can purchase stocks in minutes. On the off chance that you’re an entrepreneur, you might try and have the option to put resources into stocks through your business.

Needn’t bother with huge amount of cash to begin stock financial planning: Most retail agents, for example, Charles Schwab, let you trade stocks commission-free.2 A few representatives, for example, Devotion likewise don’t need account minimums.3 If the stock you have any desire to purchase is excessively costly, you can likewise purchase partial offers in the event that your merchant considers such investment.4

Bring in cash in two ways: The majority of investors plan to buy low and sell high. They put resources into quickly developing organizations that value in esteem. That is appealing to both buy-and-hold investors and day traders. The first group hopes to profit from short-term trends, while the second group anticipates sustained growth in the company’s earnings and stock price. The two of them accept their stock-picking abilities permit them to beat the market. Different financial backers favor a normal stream of money. They buy supplies of organizations that deliver profits. Those organizations develop at a moderate rate.5

Liquidity: The securities exchange permits you to sell your stock whenever. Financial experts utilize the expression “fluid” to imply that you can transform your portions into cash rapidly and with low exchange costs. That is significant assuming you unexpectedly need your cash. Since costs are unstable, you risk being compelled to assume a misfortune.

6 Drawbacks of Stock Financial planning

Here are a few hindrances to possessing stocks: Risk: You could lose your whole venture. Investors will sell shares of a company if it does poorly, driving down the price of its stock. At the point when you sell, you will lose your underlying venture. In the event that you can’t bear to lose your underlying speculation, then you ought to purchase bonds.6

Normal investors paid last: Favored investors and bondholders or lenders get compensated first assuming an organization goes broke.7 Yet that happens provided that an organization fails. A very much enhanced portfolio ought to stay with you safe in the event that any goes under.

Time: Before you buy a company’s stock on your own, you need to do research on each one to see how profitable you think it will be. You should figure out how to peruse budget summaries and yearly reports and follow your organization’s improvements in the information. You likewise need to screen the financial exchange itself, as even the best organization’s cost will fall in a market remedy, market slump, or bear market.

Taxes: On the off chance that you sell your stock for a misfortune, you might have the option to get a tax reduction. However, you would be required to pay capital gains taxes if you sold your stock for a profit.8 Emotional roller coaster: Every second, stock prices rise and fall. People typically sell low out of fear and buy high out of greed. The best thing to do isn’t continually take a gander at the value variances of stocks yet rather check in routinely.

Proficient contest: Institutional financial backers and expert brokers have additional time and information to contribute. They additionally have modern exchanging devices, monetary models, and PC frameworks available to them.

How to Reduce Investment Risk by Diversifying Your Stock Investments: by venture or resource type, by organization size, by area of the organization, by putting resources into shared assets and ETFs

The Equilibrium/Alison Czinkota

While putting resources into stocks is more hazardous contrasted with bonds, there are ways of decreasing your speculation risk, for example, by broadening. Enhancement implies putting resources into various kinds of resources, across various areas so you spread out your gamble. In the event that one kind of stock or resource goes down in esteem yet different sorts of speculations go up or remain something similar, your whole portfolio isn’t influenced amazingly.

Here are a few different ways you can broaden your corporate shares:

By venture type: A very much expanded portfolio will give the greater part of the advantages and less burdens than stock proprietorship alone. That implies a blend of stocks, bonds, and items. After some time, it’s the most ideal way to acquire the best yield at the least risk.9

By organization size: There are enormous cap, mid-cap, and little cap organizations. The expression “cap” means “capitalization.” It is the all out stock cost times the quantity of offers. It’s great to claim different-sized organizations since they perform diversely in each period of the business cycle. Large-cap businesses, for instance, are thought to be more stable and less susceptible to share price fluctuations. Then again, little cap organizations may be more dangerous and inclined to share cost unpredictability yet offer more prominent development potential.10

By area: Own organizations situated in the US, Europe, Japan, and developing business sectors. Expansion permits you to exploit development without being helpless against any single geology.

Through shared assets and ETFs: You can own hundreds of stocks selected by the fund manager if you own mutual funds or exchange-traded funds (ETFs). One simple method for enhancing is using record assets or list ETFs.

The Bottom Line Investing in stocks has both clear advantages and disadvantages. By and large, stocks have produced liberal returns over the long haul however putting resources into stocks additionally accompanies critical gamble. Dangers of stock money management can be spread across various stocks, areas, and topographies, in a cycle called expansion.

What amount of each sort of speculation would it be advisable for you to have? Your financial objectives and the stage of the business cycle in which the economy is currently located should guide your asset allocation, according to financial planners.

Often Got clarification on some pressing issues (FAQs)

What’s the significance here to put resources into stocks?

Putting resources into stocks implies you’re purchasing value in an organization. At the end of the day, you’re part proprietor, regardless of whether you just own a small part of the organization. By purchasing whole or fractional shares in businesses, you can invest in stocks. You can likewise purchase common assets or trade exchanged reserves that put resources into stocks.

How would you begin putting resources into stocks?

The first thing you want to put resources into quite a while is admittance to the market through an investment fund. The method involved with opening an investment fund is like that of opening a financial records. The following stage is to recognize which stocks you need to purchase and the amount you need to put resources into that specific stock. Investigate as needs be and assess your gamble craving before you go with that choice. Ultimately, put in a request to purchase the stock.

How would you bring in cash putting resources into penny stocks?

Penny stocks are commonly stocks that exchange at an offer cost of $5 or below.11 They are little organizations that desire to develop into large ones, and there’s capability to benefit from that development, but at the same time there’s the gamble that the organization won’t ever develop or may try and leave business. Penny stocks are probably not going to offer profits, and that implies you will bring in cash through capital appreciation.

How much money can you make from stock investments?

Nobody can foresee what direction a stock will head, so quite possibly’s you bring in cash and an opportunity that you lose every last bit of it. In general, the potential for gains or losses increases with the amount of money invested. The S&P 500 acquired around 10.92% each year over the 10 years finishing August 30, 2024, so somebody who had put all their cash in a S&P list reserve during that time would have created around 11% gain from their speculations each year.

Key Focus points

Putting resources into the financial exchange can offer a few advantages, including the possibility to procure profits or a normal annualized return of 10%.

The financial exchange can be unpredictable, so returns are rarely ensured.

You can diminish your venture risk by broadening your portfolio in view of your monetary objectives.