Have you ever wondered how a simple whitepaper turned into a financial revolution that’s shaking the very foundations of our monetary system? Buckle up, folks, because we’re about to take a wild ride through the fascinating evolution of Bitcoin!

1. The Genesis: Satoshi Nakamoto’s Whitepaper

1.1 The mystery behind Bitcoin’s creator

Picture this: It’s October 31, 2008. The world is reeling from a financial crisis, and out of nowhere, a mysterious figure named Satoshi Nakamoto drops a bomb in the form of a nine-page whitepaper. Talk about perfect timing! But who is this Satoshi character? Well, that’s the million-bitcoin question!

Satoshi could be a man, a woman, or even a group of people. It’s like trying to guess who’s behind a superhero mask – we might never know. But does it really matter? The idea they unleashed is what’s truly earth-shattering.

1.2 Key concepts introduced in the whitepaper

Now, let’s dive into the meat and potatoes of Satoshi’s whitepaper. It introduced some mind-bending concepts:

- Decentralization: Imagine a world where you don’t need banks. Crazy, right?

- Blockchain: A fancy word for a digital ledger that’s virtually impossible to tamper with.

- Proof-of-work: A system that makes creating new bitcoins as challenging as solving a Rubik’s cube blindfolded.

- Limited supply: Only 21 million bitcoins will ever exist. Talk about playing hard to get!

These ideas were the seeds of a financial revolution. But like any seed, it needed time to grow.

2. Bitcoin’s Early Days: 2009-2013

2.1 The first Bitcoin transaction

On January 3, 2009, the Bitcoin network sprang to life with the mining of the genesis block. It was like the Big Bang of the crypto universe! But for a while, Bitcoin was just a plaything for tech geeks and cryptography enthusiasts.

The first real-world transaction happened when Satoshi sent 10 BTC to Hal Finney, a developer who had helped refine the Bitcoin software. It was a small step for two people, but a giant leap for digital currency!

2.2 Pizza Day: Bitcoin’s first real-world use

May 22, 2010 – mark this date in your calendars, folks! This was the day when a programmer named Laszlo Hanyecz bought two pizzas for 10,000 BTC. Yes, you read that right – 10,000 BTC! At today’s prices, those might just be the most expensive pizzas in history. But hey, someone had to break the ice, right?

This transaction proved that Bitcoin could be used to buy real goods. It was no longer just magical internet money – it had real-world value!

2.3 The rise of Bitcoin exchanges

As more people got wind of this digital gold rush, they needed a place to buy and sell Bitcoin. Enter the exchanges! Mt. Gox, founded in 2010, quickly became the go-to platform for Bitcoin trading.

Imagine a bustling stock exchange floor, but instead of suits and ties, picture a bunch of computer nerds furiously typing away. That’s what the early Bitcoin exchanges were like – exciting, chaotic, and full of potential.

3. Growing Pains: 2013-2016

3.1 The Mt. Gox scandal

Remember Mt. Gox? Well, in 2014, it came crashing down harder than a house of cards in a hurricane. The exchange lost about 850,000 bitcoins, worth around $450 million at the time. Ouch!

This was Bitcoin’s first major scandal, and it was a doozy. It was like watching your favorite superhero get knocked down – painful, but necessary for growth. The Mt. Gox debacle taught the crypto world some hard lessons about security and trust.

3.2 Regulatory challenges and government scrutiny

As Bitcoin grew, it caught the eye of governments worldwide. And let me tell you, they weren’t exactly rolling out the red carpet.

Some countries, like Japan, embraced Bitcoin with open arms. Others, like China, gave it the cold shoulder. It was like Bitcoin was the new kid in school, and different countries were deciding whether to befriend it or stuff it in a locker.

Regulators were scratching their heads, trying to figure out how to classify this new asset. Is it money? Is it property? Is it magic internet dust? The debate raged on, and Bitcoin found itself in a legal gray area in many parts of the world.

3.3 The emergence of Bitcoin alternatives

Bitcoin’s rise to fame inspired a wave of imitators and innovators. Suddenly, the crypto market was flooded with alternatives – or “altcoins” as the cool kids call them.

Litecoin, Ripple, Ethereum – it was like a crypto alphabet soup! Each promised to be faster, more efficient, or more versatile than Bitcoin. But Bitcoin held its ground, like a sturdy oak tree in a forest of saplings.

4. The Road to Legitimacy: 2017-2019

4.1 The 2017 bull run and media frenzy

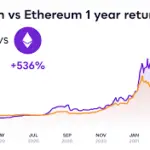

2017 was the year Bitcoin went mainstream, big time! The price skyrocketed from about $1,000 to nearly $20,000. It was like watching a rocket ship take off – exhilarating and a little bit scary.

Suddenly, everyone and their grandma was talking about Bitcoin. It was on the news, in your Facebook feed, maybe even discussed over Thanksgiving dinner. Bitcoin had become a household name, for better or worse.

4.2 Institutional interest and futures trading

With all this attention, the big boys of finance started to take notice. Wall Street, which had previously dismissed Bitcoin as a fad, was now dipping its toes in the crypto waters.

The launch of Bitcoin futures on major exchanges like CME and CBOE was a game-changer. It was like Bitcoin had finally been invited to sit at the cool kids’ table in the financial cafeteria.

4.3 The scaling debate and Bitcoin Cash fork

But with growth came growing pains. The Bitcoin community found itself embroiled in a heated debate about how to scale the network to handle more transactions.

It was like a family feud, but instead of arguing over who gets grandma’s china, they were arguing over block sizes and transaction speeds. The disagreement led to a “hard fork” in 2017, giving birth to Bitcoin Cash.

This split showed that even in the decentralized world of crypto, consensus isn’t always easy to achieve. But hey, what’s a good story without a little drama, right?

5. Bitcoin in the Modern Era: 2020-Present

5.1 COVID-19 and Bitcoin as a hedge

Enter 2020 – the year that turned the world upside down. As traditional markets wobbled under the weight of the pandemic, Bitcoin found itself in the spotlight once again.

With governments printing money faster than you can say “inflation,” many saw Bitcoin as a potential hedge against economic uncertainty. It was like a financial bomb shelter in a storm of economic chaos.

5.2 Corporate adoption and Bitcoin on balance sheets

In a plot twist worthy of a Hollywood blockbuster, major corporations started adding Bitcoin to their balance sheets. Tesla, Square, MicroStrategy – these weren’t fringe tech companies, but major players making big bets on Bitcoin.

It was like watching the cool kids in school suddenly decide that the nerdy kid’s hobby was actually pretty awesome. Bitcoin was no longer just for cypherpunks and speculators – it had entered the corporate world.

5.3 El Salvador’s Bitcoin experiment

In 2021, El Salvador made history by becoming the first country to adopt Bitcoin as legal tender. It was like watching a small country strap a rocket to its back and blast off into the crypto future.

The world watched with bated breath. Would this bold move pay off, or would it crash and burn? Only time will tell, but one thing’s for sure – El Salvador’s experiment has put Bitcoin on the global stage like never before.

6. The Future of Bitcoin

6.1 Potential technological advancements

So, what’s next for our digital gold? The Bitcoin network is constantly evolving, with developments like the Lightning Network promising faster, cheaper transactions.

Imagine if you could buy your morning coffee with Bitcoin as easily as you use a credit card. That future might not be as far off as you think!

6.2 Regulatory outlook and challenges ahead

Of course, the road ahead isn’t all smooth sailing. Regulators worldwide are still grappling with how to handle Bitcoin and its crypto cousins.

Environmental concerns about Bitcoin mining, potential government crackdowns, and the ever-present threat of hacks and scams – these are all hurdles that Bitcoin will need to overcome.

But if there’s one thing Bitcoin has proven over the years, it’s resilience. From a obscure whitepaper to a global phenomenon, Bitcoin has come a long way. And something tells me its journey is far from over.

Conclusion

From its mysterious birth in a whitepaper to its current status as a household name, Bitcoin has had quite the journey. It’s weathered scandals, survived market crashes, and defied its critics time and time again.

Whether you’re a die-hard Bitcoin believer or a skeptical observer, there’s no denying the impact this digital currency has had on our world. It’s challenged our notions of money, sparked a technological revolution, and given us a glimpse of what a decentralized future might look like.

As we look to the future, one thing’s for certain – the Bitcoin story is far from over. Will it become the global currency of the future, or will it be remembered as a fascinating experiment in digital finance? Only time will tell. But one thing’s for sure – it’s going to be one heck of a ride!